Adjusted Floor Valuation Algorithm

This blog post will dive deeply into one of our primary valuation algorithms, the Adjusted Floor (AF). We will discuss what it is, why we use it, and how it's calculated. Let's get started!

The adjusted floor is our mathematical and straightforward approach which takes into consideration floor prices of individual properties of an NFT.

The Market Cap of NFT collections on various websites is often derived from the collection's floor price multiplied by the total number of tokens in the collection. This method does not provide a collection's realistic market cap, but it indicates the absolute minimum market cap. We have learned from studying hundreds of NFT collections that rarely do the items in a collection have the same value (except ERC1155 NFTs at a given point in time). This means that a more refined approach is required, which looks at NFTs individually to derive a valuation for them.

This method values NFTs on an individual basis using each NFT's rarest and most valuable trait. And market cap will be the sum of AF valuations of every NFT in the collection.

Technical Deep-Dive

To calculate the Adjusted Floor of each property, we look at the cheapest token with that property that is currently listed for sale. If there are no tokens with that property listed, we either take the price of the last sale of that property or the last sale of the collection, whichever is higher. This value is then compared with the highest of the last sale of a token with that property and the last sale of the collection. If it is five times higher, then that value is used instead. With this check, we eliminate the possibility of the market cap being distorted by rare traits with unrealistic values.

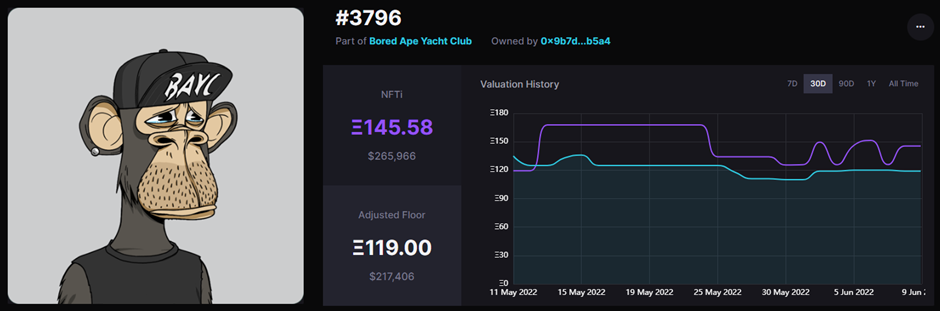

Let's take BAYC #3796 as an example. This token's rarest property is the "Bayc Flipped Brim Hat". At the time of writing, the cheapest token listed for sale with that property is BAYC #2616 for Ξ119. The most recent sale of an NFT with that property was again BAYC #3796 for Ξ125.69, and the most recent sale of any NFT in that collection was BAYC #1717 for Ξ127, from which we look at the highest price of the two NFTs, that is Ξ127. Now we compare the price of the cheapest token with this property that is currently listed for sale (Ξ119) with the previous price (Ξ127), and since it's not more than five times higher, we use the value of Ξ119 as the AF for this property, and subsequently, the AF of BAYC #3796 will also be Ξ119 since the "Bayc Flipped Brim Hat" is its highest-valued trait.

While we believe that using the Adjusted Floor provides a more realistic estimation than simply multiplying the floor price of a collection with the token supply, we are aware that this method is not flawless. For example, since AF uses the tokens' rarest trait, it won't be as effective with NFTs that have more than one rare trait or with 1/1 NFTs. Therefore, the AF valuation method often results in an undervaluation of NFTs that are grails, 1/1s, or have a combination of rare/desirable traits.

And that's all about our Adjusted Floor valuation algorithm! Thank you for reading our post, and if you found it interesting or if you are curious about how we do things in general, you might want to check out our Methodology documentation or our blog post about our NFTi valuation algorithm.